What is a Security Token Offering (STO) and Could it Replace the ICO?

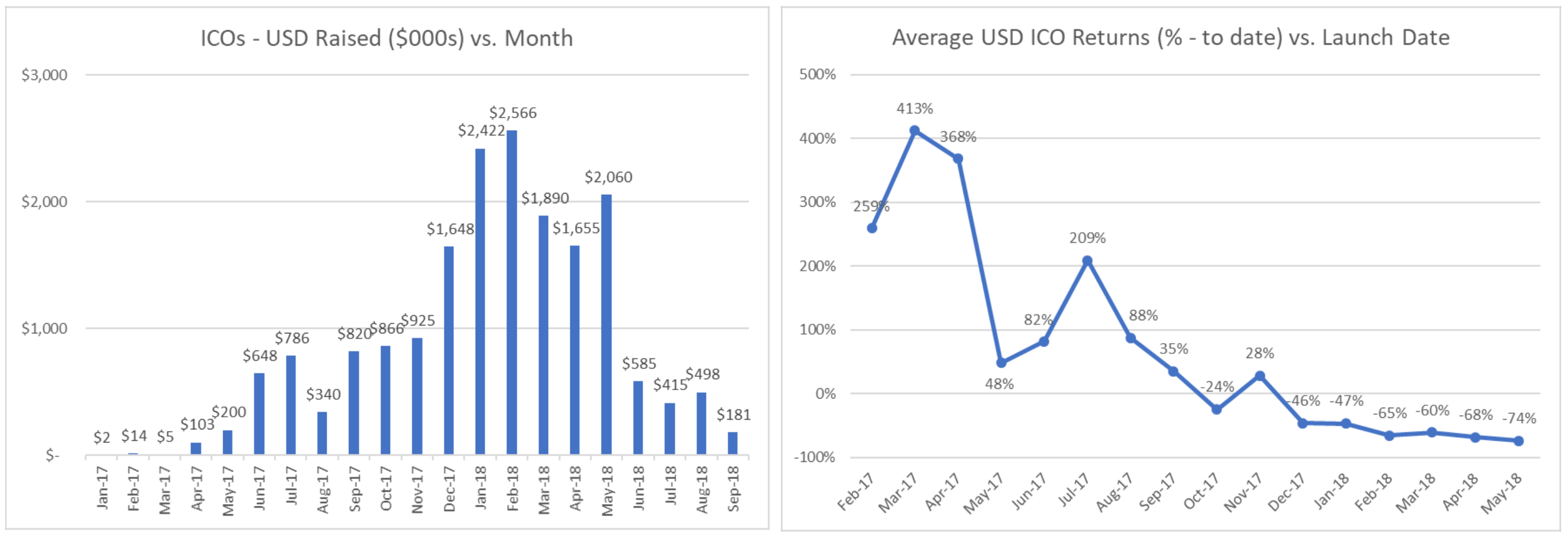

In 2017, there were 875 Initial Coin Offerings (ICOs), raisingUS$6,23 billion, which equals on average US$7,12 million per ICO. In 2018, there were 1257 ICOs that raised US$7,85 billion, which comes down to an average of US$6,25 million. Not surprisingly, the vast majority of these ICOs were done in the first months of 2018. In the past four months of 2018, the total amount raised was $873 million. There are no details yet on the deals done so far in 2019, but it can be safe to say that the amount will not be high. In the past years, we have seen the rise and fall of the Initial Coin Offering.

Source: TokenData, Node Blockchain Research

The ICO appeared in 2013 when the Mastercoin project raised US$5 million in the first ever ICO. One year later, Ethereum raised US$15 million for the further development of Ethereum. Unfortunately, with the rise in value of cryptocurrencies, we have also seen a significant increase in scammers who tried to get rich quickly. These scammers negatively affected many honest startups who saw the Initial Coin Offering as a relatively simple way to raise funds for their project.

The Era of the ICO is Over

Nowadays, doing an ICO has become very expensive. Due to the nature of ICOs, investors have no protection, resulting in many governments creating ICO regulations to protect them better. Unfortunately, these regulations differ across the globe and with ICOs being a global product, startups have to comply with a wide variety of regulations. In addition, ICOs require roadshows to promote the ICO, which add up to the costs. As a result, doing an Initial Coin Offering is now very expensive, and it is better to use that money for the development of the actual product or platform. Therefore, I believe that the era of the ICO, or the Token Generation Event (TGE) as it is sometimes called now, is over. It was a great run, but the fun is over.

The idea of using a token to raise funds, however, offers a lot of benefits. With an ICO, these benefits are predominantly for the startup: large sums of money without losing any equity or voting rights. The investor, on the other hand, can only hope that the startup founders stick to their promises, as there is zero investor protection. This explains why investors have lost interest in this now, which is a sign of market maturity. It is, therefore, not a surprise that a new funding model appears. One that benefits not only companies but also investors.

Enter the Security Token Offering (STO)

The idea of an ICO was to launch a utility token. A utility token is a token that provides the buyer with future access to a product or service or gives the buyer certain voting rights within the network. However, the Securities and Exchange Commission (SEC) argues that many of the offered tokens are, in fact, a security token as both buyer and seller expect a rise in token price resulting in a profit.

A token is a security token if it fulfils the four criteria set out in the Howey Test. A security token offers the buyer certain rights and obligations in a particular asset, whether it be a stake in a company or (part) ownership of real estate, art or digital assets. A security token is subject to regulations. Not complying with these regulations can result in (severe) penalties.

Distributing security tokens is done during a Security Token Offering (STO). Depending on how the STO is structured, it can give the investors a lot of benefits, such as the ability to voice their opinions through voting, gain access to dividends and other rights based on the proportionate ownership in the underlying asset or company. However, an STO not only benefits the investors, but it also has significant benefits for the issuer as well as other stakeholders such as regulators.

5 Benefits of the Security Token Offering

There are multiple stakeholders involved with a security token, including the issuer, buyer, regulator and exchanges. Traditionally, accessing public markets as a funding source was only possible for the biggest companies, but with an STO also smaller companies can now target the public market for funding. It offers investors a tool beyond speculation, provides transparency to regulators and offers a new business model for (crypto) exchanges. In general, there are five major benefits of an STO compared to traditional securities:

1. Security Tokens are Programmable

The main benefit of security tokens over traditional financial securities is that they are programmable. This means you can incorporate certain rules within the security token that automatically apply. These rules could be related to dividend release (the longer you hold a token, the more dividend you will get), voting rights (the longer and the more tokens you have, the more voting rights you will get) or other privileges. These rules can then become an effective way to incentivise ownership and ensure price stability.

2. 247 Full Liquidity

Current securities can only be traded from 9-5 on weekdays. In addition, often securities require a few days before they are settled. Using blockchain technology tokens can be settled instantly or within a few minutes. As such, a utility token can be settled a lot faster than traditional securities. When there is a secondary market to exchange utility tokens (which currently there is none, but more on that later), it offers investors full liquidity on their assets. Compared to traditional investments, such as real estate that takes months to sell, this is a significant benefit for investors.

3. Global Market Accessibility

Whenever an organisation decides to create an Initial Public Offering, it has to decide where they want to do their IPO. This can be in the country where the company’s headquarter is, or in another country depending on regulations, market demand or other reasons. However, with an IPO, an organisation can never offer their shares across the globe. This is different for security tokens.

As we have seen with ICOs, blockchain technology does not care about borders and startups have raised funds from everywhere in the world. As an example, the company Origin Protocol raised US$6,6 million from 1800+ investors across 50 countries. The same applies to STOs. All of a sudden, an organisation can offer their security to the global market, giving it a much higher chance of success. In addition, launching an IPO in multiple markets would generally involve a lot of fees to banks and advisors in the different markets. This is not the case during an STO, thereby lowering the fees to raise funds.

4. Fully Traceable and Embedded Compliance

Regulatory compliance is key for security tokens. However, regulations vary depending on investor type, asset type or jurisdictions. Incorporating them all would normally be a hassle. However, since security tokens are programmable, the regulations can be embedded in the code. It means that regulations become exponentially easier and automatic once the system is set up.

In addition, security tokens are fully traceable, similar to utility tokens. With any cryptocurrency, it will always be possible to trace a coin throughout the years, to see who owned it and for how long. This will bring transparency to the markets and those stakeholders involved.

5. Fractional Ownership

Last but not least is the possibility of fractional ownership. Investors like to divest to hedge their risks. However, in the current situation, fractional ownership is very complicated when dealing with high-priced assets such as real estate or art. With a security token, it becomes possible to own a small part of a building in one side of town and another part of a building in a different area. Instead of spending all funds on one building, thereby increasing your risk, you can now divest your money across multiple properties. This would greatly reduce your risk. Since these assets are now also highly liquid, it gives an investor a lot more options.

What are the Challenges of an STO?

However, not all is rosy as there are also some significant challenges that need to be overcome before a Security Token Offering can be a useful replacement to an ICO. First of all, they are far more complex than doing an ICO. The moment you decide to do an STO, you will have to comply with a lot of regulations and especially the SEC will follow you closely. Therefore, it requires a lot of preparations and significant legal advice to make sure you are doing an STO that is fully compliant. However, already multiple companies offer services to help with an STO, so likely it will become a bit easier in the near future.

The second challenge is related to exchanges. One of the main benefits of a security token is its liquidity, which means that an investor can sell a token at any time they want. To sell a token, you need a secondary market, or an exchange (when a security is sold for the first time, it is called a primary market offering, but when the investor wants to trade their investment, it is called trading in a secondary market). Naturally, these exchanges will be required to comply with the most extensive regulations, which means it is difficult to develop a new exchange for security tokens. Existing exchanges such as Coinbase do recognise the opportunity that STOs offer and are preparing (i.e. getting the required licenses) to allow secondary trading of security tokens. On the other hand, Overstock’s security token exchange platform tZero is going live later this week. Also, traditional exchanges see the opportunities that STOs will bring and exchanges such as the Australian Securities

Exchange (ASX), Gibraltar Stock Exchange (GBX), SIX Swiss Exchange (SDX), London Stock Exchange (LSE), Malta Stock Exchange (MSX) and the Canadian Securities Exchange (CSE) will all be offering STO listing and secondary trading. It is, therefore, a matter of time before this challenge will be solved.

Will the STO Replace the ICO?

The answer is YES. Although, it might take a while as the required ecosystem is not yet there, and regulations are also still being developed. The benefits of an STO over an ICO are too big to ignore, and investors will simply no longer accept tokens that offer no security whatsoever. Once there are sufficient secondary markets to ensure the liquidity of the security tokens, and there is clarity from regulators, we will see a big rise in Security Token Offerings and the ICO will disappear to the background.

If you are interested in reading more about STOs, here are some useful sources that I used to write this article:

- The Security Toke Thesis

- What are Securities and Security Tokens

- What are Security Tokens?

- Security Tokens Explained for Beginners (Everything You Need)

- Security Token Offerings The Evolution of Capital Formation

Image: Kkssr/Shutterstock